We’re only a couple of months into 2024, but wealth.com’s product team has been hard at work to deliver exciting new features. With a focus on providing continued value to our advisor partners and their clients, check out our newest releases below.

We welcome any feedback or questions: [email protected].

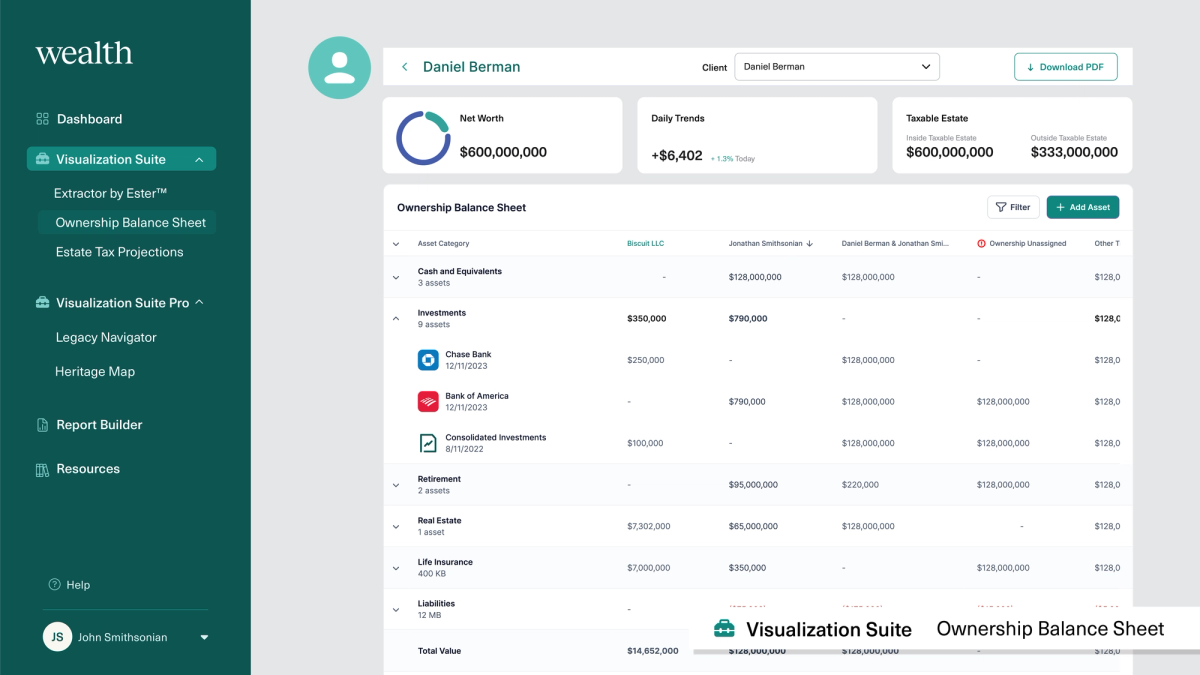

Build Your Client’s Ownership Balance Sheet

Advisors are now able to build out their client’s Ownership Balance Sheet, starting with creating assets and further recording ownership and beneficiary designations on their client’s behalf. Understanding how assets are owned is essential for financial and estate planning, and the Ownership Balance Sheet helps advisors bridge the gap with their clients to create a properly structured estate plan and make it easier for loved ones and decision-makers, such as an executor, to administer assets when the time comes.

Salesforce Integration

Wealth.com was built to fit seamlessly into financial advisors’ existing tech stacks, ensuring you keep your operations and client information organized from your preferred access point. Our advisors who use Salesforce now have visibility into their client’s complete estate planning process directly from their CRM, including updates about client activity and quick information about the status of their documents. Read more about our integration with Salesforce here.

Customized Sub-Trusts for Joint Revocable Trusts

We’re excited to announce that we’ve enhanced the ability for clients to better customize their Joint Revocable Trust to include sub-trusts, including a Marital Trust, Trust for Descendants, or a simpler Holdback Trust. As your client drafts their Joint Revocable Trust, their answers will help them to determine whether any of these sub-trusts should be included in their document. Please note that the ability to include a customized Marital Trust and/or Trust for Descendants is available for your client in their Individual Revocable Trust workflow and is coming soon for the Last Will & Testament.

We are proud to work closely with our advisor partners and their clients to provide the tools to create, visualize and manage their estate plans over time. We want to hear from you. Please share your feedback with us!