Today, we’re announcing our Family Office Suite™, our cutting-edge collection of technologies for highly complex estate plans. These new features empower financial advisors to visualize their clients’ estate plans, model out potential scenarios and optimize for tax alpha. This is a major step forward in helping advisors reduce manual efforts and scale their estate planning services while providing greater clarity for their clients.

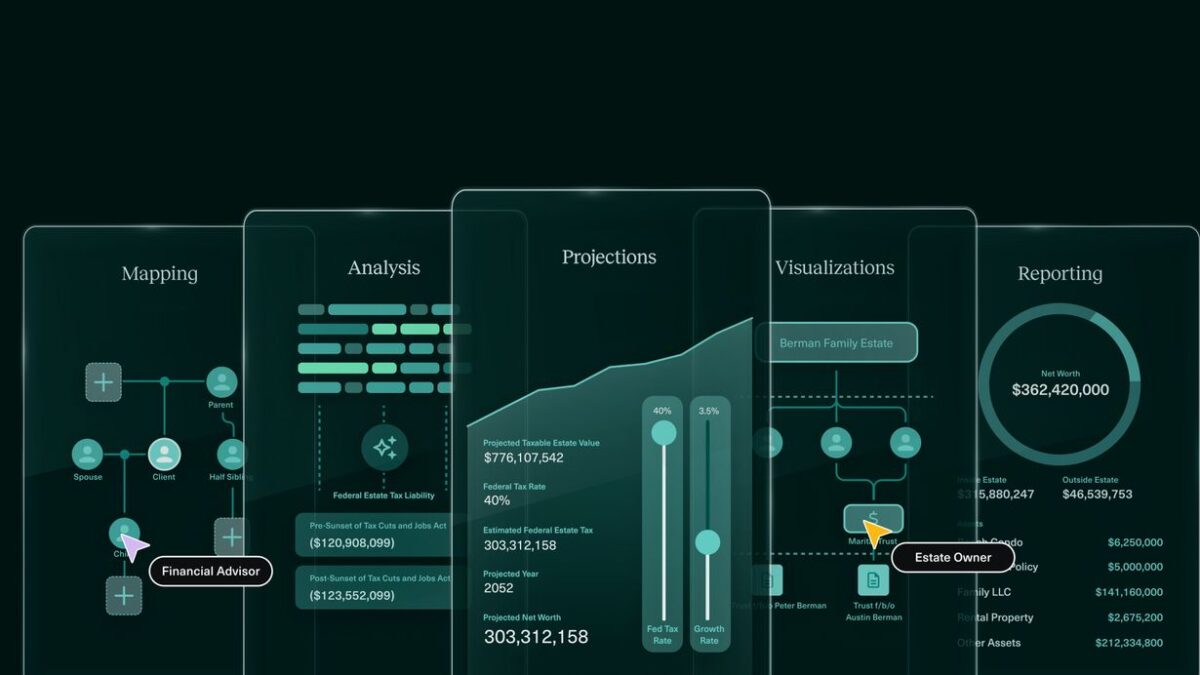

Family Office Suite™ introduces new features into the wealth.com platform while establishing the connectivity between existing features to seamlessly collect, structure, model and visualize all information in a clients’ estate plan, culminating in an elegant, personalized and co-branded client deliverable.

Over 400+ wealth management institutions already trust wealth.com to elevate their estate planning services. Now, they can rely on our modern approach to estate planning, built with revolutionary technology, for a better way to manage their clients’ estates, even for the most complex plans, especially high-net-worth (HNW) and ultra-high-net-worth (UHNW) households.

With Family Office Suite™, advisors gain the ability to:

- Visualize the complex. With new features, including EstateFlowTM, Irrevocable Trust One-Pagers, Heritage Map, Legacy NavigatorTM and, advisors will be able to demystify and bring to life estate planning nuances like sub-trust distribution schemes, federal and state estate tax implications, Generation-Skipping Transfer Tax (GST) exempt and non-exempt trust breakdowns, administrative costs and more.

- Quantify tax alpha. Estate tax calculators and scenario analysis capabilities give advisors the ability to quantify tax implications and identify tax optimization opportunities.

- Organize and collaborate. Advisors can simplify data collection by leveraging the wealth.com Vault and Ester™ AI to instantly extract and centrally store all key information from estate planning documents. Collaboration is further enhanced between advisors, in-house specialists and important intermediaries through in-app tooling and direct API integrations with leading CRM and Portfolio Management systems.

- Deliver refined reports. Financial advisors can create the ultimate client deliverable, in seconds, using the Report Builder. Wealth.com does the heavy lifting by transforming all underlying client data into ready-made visuals and slides. All reports can be firm-branded, complete with custom colors, fonts and logos.

“As we advance our product roadmap, particularly for advisors serving high-net-worth and ultra-high-net-worth clients, we are committed to transforming all aspects of the estate planning service model to be a more efficient and effective process,” said Danny Lohrfink, chief product offer and co-founder of wealth.com. “The Family Office Suite not only elevates the client experience but also unlocks greater productivity for advisors—what used to take weeks now takes mere minutes. ”

Ready to provide your clients unparalleled clarity and insight on their estate plans? Get a demo.