Real estate is often one of the most valuable assets in a person’s estate. Whether it’s your primary residence, a vacation home or an investment property, it’s important that your real estate is properly accounted for in your estate plan. Failing to do so could lead to a lengthy probate process, unexpected taxes for your heirs or even the loss of a family property.

For many people, placing real estate into a trust can be the best solution. Doing so allows the property to avoid the time-consuming and public probate process. It also ensures the real estate will seamlessly pass on to your beneficiaries according to the terms you’ve outlined in your trust.

This article will detail what to consider about properties and real estate, and the potential options for incorporating those assets into an estate plan.

Why planning ahead for property in estate planning matters

Real estate is not like other assets. It can’t be easily divided up and distributed to heirs like cash in a bank account.

Real property must go through a legal transfer of title to pass ownership to the next generation. Without proper planning, this transfer process can become complicated and complex for beneficiaries.

Here’s why you want to have a process in place:

1. Avoid probate: Any assets that are not in a trust when you pass will likely have to go through probate. This is true of any real estate or properties too. During probate, your beneficiaries will not have access to the property, including rental properties. Your estate will still go through probate even with a will in place, though it should make the process smoother.

2. Minimize taxes: Without proper preparation, your heirs could be hit with a hefty tax bill when they inherit your real estate. While the federal estate tax exemption is high ($13.99 million per individual in 2025), several states may have their own estate or inheritance taxes with much lower thresholds. Proper estate tax strategies for your real estate can help minimize or, potentially, eliminate this.

3. Clarify your wishes: Real estate often has sentimental value in addition to monetary value. Perhaps it’s the home where your children grew up or a lakeside house where extended family has gathered for summer vacations. Putting your wishes in writing can prevent arguments between family members, specifying whether it should remain in the family or if sale proceeds are to be split among beneficiaries.

4. Plan for incapacity: An estate plan doesn’t just address what happens after you die. It should also protect you and your assets during your lifetime, in the event you become incapacitated by illness or injury. Let’s say you own a rental property that provides a stream of income. If you were to suddenly become unable to manage the property, who would handle tasks like collecting rent, paying property taxes and coordinating repairs? Without a Financial Power of Attorney in Place, your family would have to petition the court to appoint a guardian—an expensive and stressful process.

How to pass real estate to your beneficiaries

Let’s look at some of the different ways you can pass property to your heirs.

Leave it in your will

The most basic option is to name the beneficiary for each piece of real estate in your will. Upon your death, the executor of your estate will be responsible for ensuring the property is formally transferred to the new owner.

The downside of using a will is that the property will have to go through probate before your beneficiary can take ownership.This can be a time-consuming process, and your heirs will likely need to hire an attorney to navigate the legal complexities, resulting in additional costs and delays

Form a limited liability company (LLC)

If you own rental properties or real estate used for a business, you might consider transferring those properties into a limited liability company (LLC). An LLC provides liability protection, shielding your personal assets if someone were to sue over something that occurred on the property. An LLC may also provide tax benefits.

Once the LLC is created and funded with your real estate, you can leave the corporate shares to your beneficiaries in your will or trust. Upon your death, they will inherit ownership of the LLC and the real estate it holds.

Placing rental properties into an LLC also allows your beneficiaries to easily split ownership of the real estate after your passing. Rather than arguing over who gets which property, they will each own a percentage of the LLC. If one heir wants to be bought out, the others can purchase their corporate shares.

Put it in a trust

A Revocable Trust is often the preferred method for leaving real estate to your beneficiaries. Here’s how it works: You create the trust and name yourself as the trustee. Then you transfer ownership of your real estate into the trust by filing a new deed.

The core action involved in transferring real estate into a trust is to change the title of the property. Currently, you likely hold the title to your real estate holdings in your own name (or jointly with a spouse). To place it in a trust, you’ll need to retitle it in the name of the trust itself.

This retitling keeps the property out of probate upon your death. Instead of going through the probate process, the real estate will immediately pass on to your beneficiaries and be handled according to the instructions you’ve laid out in your trust documents. The trustee you’ve appointed will be responsible for managing the property and transferring it to your heirs as specified.

Trusts provide a great deal of flexibility and control over how your real estate is managed and distributed. You can specify that a property be sold immediately, held for a certain number of years or kept in the family for generations. You might stipulate that a beneficiary can live in a home rent-free or that rental income be used to pay for a grandchild’s college education.

It’s important to note that transferring real estate into a Revocable Trust does not remove it from your taxable estate. However, an Irrevocable Trust can be used to minimize estate taxes for high net worth individuals. Since irrevocable trusts cannot be easily changed once they are funded, they are usually used in conjunction with, not as a substitute for, a Revocable Trust.

Common concerns

Many people worry that retitling property into a trust will impact things like property taxes, insurance coverage or mortgage terms. Fortunately, in most cases, this is not an issue. The transfer does not constitute a sale or change in ownership, so property tax assessments and exclusions like Proposition 13 in California remain unaffected.

Similarly, your existing homeowners insurance policy and mortgage should remain valid and unchanged, although it’s prudent to notify your insurance provider and mortgage lender of the title change so they can update their records. At most, they may have you sign a trust rider agreement.

What married couples should consider

For married couples, there are two common options when it comes to placing real estate in a trust:

- Retitle the property to be owned 50% by each spouse’s individual trust. This allows each person to specify their own beneficiaries and terms for their half of the property.

- Create a joint trust and place full ownership of the property into that single trust. The couple will need to agree on beneficiaries and terms in the joint trust.

There are pros and cons to each approach that are worth discussing with an estate planning professional. If a couple opts for a joint trust, they should consider what will happen to the property if they divorce in the future.

What happens to real estate not placed in a trust?

Any real estate that you opt not to retitle—or simply forget to retitle—into your trust will have to go through the probate process before it can pass on to your heirs. Probate can be a lengthy and expensive process, and it makes the transfer of the property a matter of public record.

There are some alternatives to trusts that may still allow you to avoid probate for certain property (more on that below), but in general, if you do nothing, your real estate holdings will be subject to probate.

Recording the retitling with a deed

To officially transfer your real estate into a trust, you’ll record a new deed with your county recorder’s office showing the trust as the owner.

Typical deeds used for this purpose include grant deeds, warranty deeds or quitclaim deeds, depending on your location and situation. Your financial advisor or estate attorney can advise on the proper format. The deed will include a detailed legal description of the property being transferred.

Most counties no longer require you to obtain a physical copy of the new deed. Digital recordings are sufficient—you can typically complete the whole process online through your county recorder’s website.

Regional variances in requirements may apply. For instance, Massachusetts does not require you to provide a full copy of your trust agreement when transferring property. Instead, you record a separate trustee certificate along with the new deed.

Alternatives to trusts for passing on real estate

While placing real estate in a trust is an effective way to efficiently transfer it to heirs outside of probate, there are some alternative methods options.

Transfer on Death deeds

Some states allow you to set up a “Transfer on Death” (TOD) deed that automatically transfers ownership of a property to your designated beneficiary upon your death, without the need for a trust or probate.

The TOD deed lists your chosen beneficiary but doesn’t give them any ownership rights until your death. You can change the beneficiary at any time.

This can be a good option for people who only want to specify what happens to their property after death and aren’t concerned about the other benefits trusts provide during their lifetime. But if this is appealing, look into whether TOD deeds are valid in your state.

Life Estate deeds

With a life estate deed (sometimes called a “ladybird deed”), you grant yourself ownership of a property for the rest of your life, and then specify the person you want to inherit the property after you pass away.

This gives you the right to continue living in or renting out the property for your lifetime. Your named beneficiary (legally known as the “remainderman”) automatically inherits the property upon your death without the need for probate.

However, life estate deeds can create complications if you want to sell the property, since the remainderman also has an ownership interest and would need to agree to the sale. Additionally, depending on how long you live, it could impact the capital gains tax your heirs will owe when they eventually sell the property.

Making a property your primary residence for at least two out of five years prior to selling provides a significant capital gains tax exclusion—an advantage your heirs may not qualify for if they inherit through a life estate deed

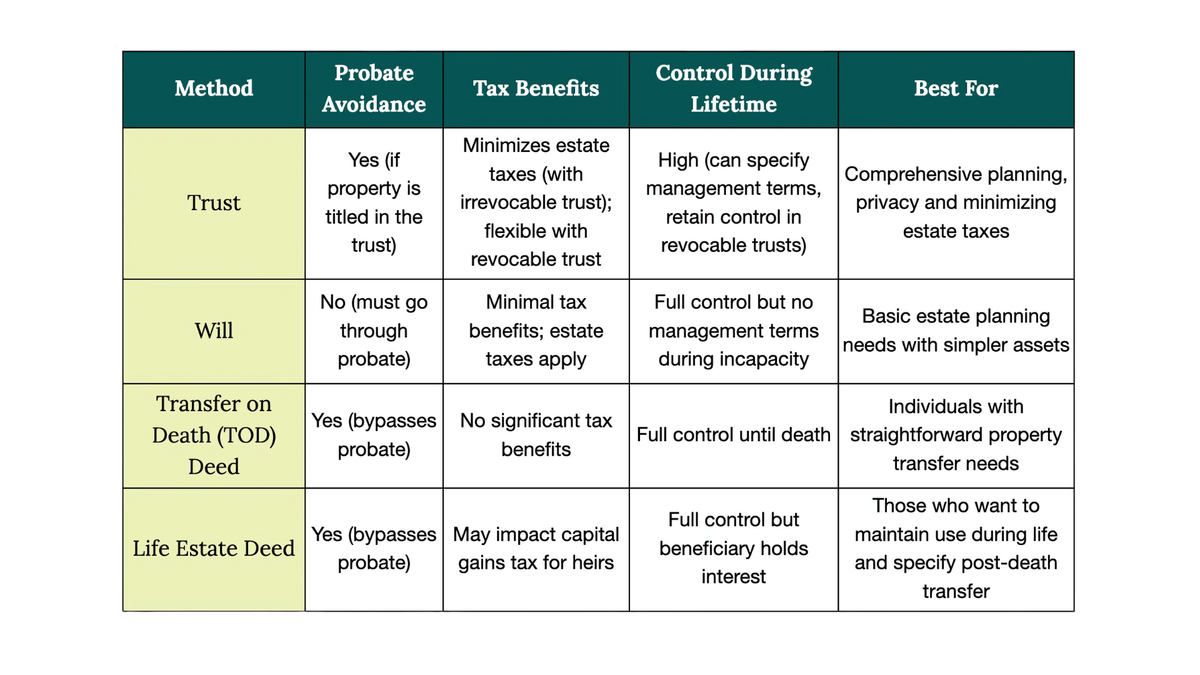

Here’s a simple chart to help understand these different options:

Advanced strategies for estate tax planning

While trusts and careful planning can help minimize taxes for most estates, individuals with large estates, valuable properties, or unique circumstances may benefit from advanced strategies. One such option is the Qualified Personal Residence Trust (QPRT), which offers specific tax advantages.

With a QPRT, you place your property into an Irrevocable Trust for a set length of time, while continuing to live in it. Once the term ends, the property transfers to your beneficiaries (usually your children).

The advantage is that the property is valued for gift tax purposes at the time it’s placed into the trust, not at its value when it eventually transfers. So a $2 million property placed in a 10-year QPRT might only count as a $1.2 million gift, reducing your taxable estate.

The catch is that if you die before the QPRT term ends, the property will revert back to your taxable estate. Planning based on your age, life expectancy, and desired length of stay is required. QPRTs also cannot be revoked if your circumstances change.

Especially for high net worth estates, it’s worth consulting with an experienced estate planning attorney to determine if a QPRT or similar advanced strategy might be advantageous for your situation.

Why financial advisors are key to estate planning

Real estate and taxation issues are complex, but financial advisors have the expertise to guide clients through the nuances of incorporating real estate into estate plans. By offering informed, actionable advice, they help clients clarify their goals, navigate options and achieve peace of mind.

Advisors can assist clients by:

- Understanding their goals: Who should inherit their properties? Are there specific conditions or sentimental attachments to certain real estate?

- Assessing their portfolio: What is the value of their real estate holdings? How do these assets fit into their broader financial and estate planning objectives?

With this clarity, advisors can recommend tailored strategies, such as creating a trust, forming an LLC for rental properties or how to approach advanced tax planning techniques like a Qualified Personal Residence Trust (QPRT).

Are you a wealth manager? See how you can start helping their clients with their estate plans and property assets. Book a demo today.