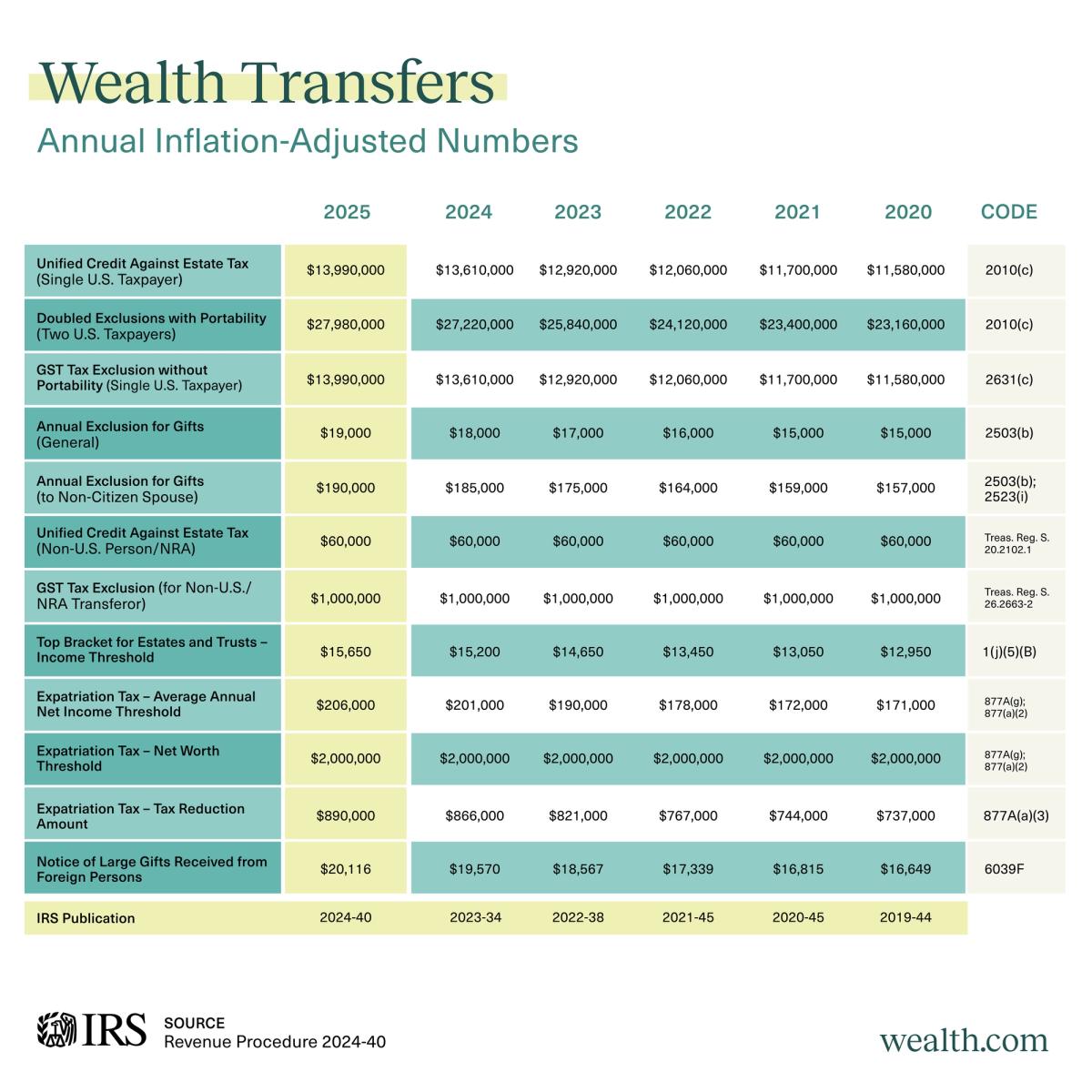

The IRS just released its 2025 numbers adjusted for inflation. These can have a significant impact on wealth and estate planning.

For many people, the major take away is that the annual gift exemption is increasing to $19,000. For those that already have a gifting strategy or plan significant gifts in 2025—such as contributing to tuition or a down payment for a family member—this increase can help with certain tax strategies.

The other takeaway is the lifetime estate and gift tax exclusion is increasing to $13.99 million for individuals and $27.98 million for married couples, which applies to clients that have high-net worth estates. In 2025, this is even more significant because the Tax Cuts & Jobs Act (TCJA) is set to sunset at the end of the year. Unless Congress extends the provisions in the TCJA, the estate and gift tax exclusion will return to pre-2018 numbers—adjusted for inflation, it would likely be at just under $7 million for individuals.

That’s why it’s for critical for financial advisors to review these 2025 numbers alongside your clients’ plans to understand if there is any impact or opportunities for new estate tax strategies next year.

We reviewed Revenue Procedure 2024-40 and pulled out only the relevant numbers for wealth planning to provide advisors, and their clients, a simple reference chart. View it below or download a version that you can keep handy.

Actionable takeaways & impacts

While the impact of these wealth transfer-relevant numbers on your clients’ estate plans will depend on their financial situation—for example, individuals with taxable estate well under $13.99 million are likely to be unaffected by the lifetime exemption—there are potential strategies you can employ for those that could be impacted.

Here are some examples of how you can use these numbers to create a strategy for affected clients in 2025:

1. Maximize lifetime wealth transfer

Your clients can now contribute significantly to irrevocable trusts and/or make substantial gifts without incurring taxes due to the increase in the lifetime estate and gift exemption to $13.99 million for individuals and $27.98 million for married couples.

This allows you and your clients to optimize their estate planning strategies, especially if they expect to be impacted by the TCJA sunset at the end of 2025.

2. Monitor taxable gifts

Next year, the annual gift tax exclusion is increasing to $19,000. This means your clients are able to give even more without triggering gift tax. Only anything above that amount will start to impact their lifetime exclusion.

If a client already has a gifting strategy in place, for example providing gifts to their grandchildren every year, make sure they know that they are now able to increase their non-taxable gifting amount.

You should also ensure that you’re helping them track their gifting amounts. If they exceed the $19,000 they will need to file a Form 709 to report taxable gifts.

3. Leverage 529 plan contributions

Due to the annual gift tax exclusion increase, clients can now contribute up to $95,000 to a 529 plan in a single year by utilizing the five-year election option.

This can be beneficial for your clients that are looking to superfund their children’s or grandchildren’s education funds without incurring fit taxes.

4. Evaluate trust tax implications

If your clients are considering irrevocable trusts, you should assess who will be the taxpayer for the trust (i.e. is it a Grantor Trust).

This evaluation helps your clients weigh potential estate tax savings against higher income taxes, providing a clearer financial picture for them.

5. Understand non-resident alien tax implications

Be mindful of the different estate and gift tax thresholds that apply to non-resident aliens. These can have a significant impact on planning strategies.

This chart will help you navigate those complexities more effectively.

6. Address expatriation and foreign gifts

For your clients that are considering moving to a foreign country, renouncing their citizenship or green card status and/or receiving large gifts from abroad, you should be aware of the reporting requirements and tax implications.

This chart will help you quickly find the new thresholds so you can ensure compliance for your clients and avoid any penalties.

Get Your Free 2025 IRS Reference Guide

Download