At wealth.com, we pride ourselves on moving quickly and listening to our partners to build impactful solutions that allow them to be integral to their clients’ estate planning process.

We’re thrilled to share an update from the month of October of new features and functionality to provide our advisors with the most comprehensive estate planning solution.

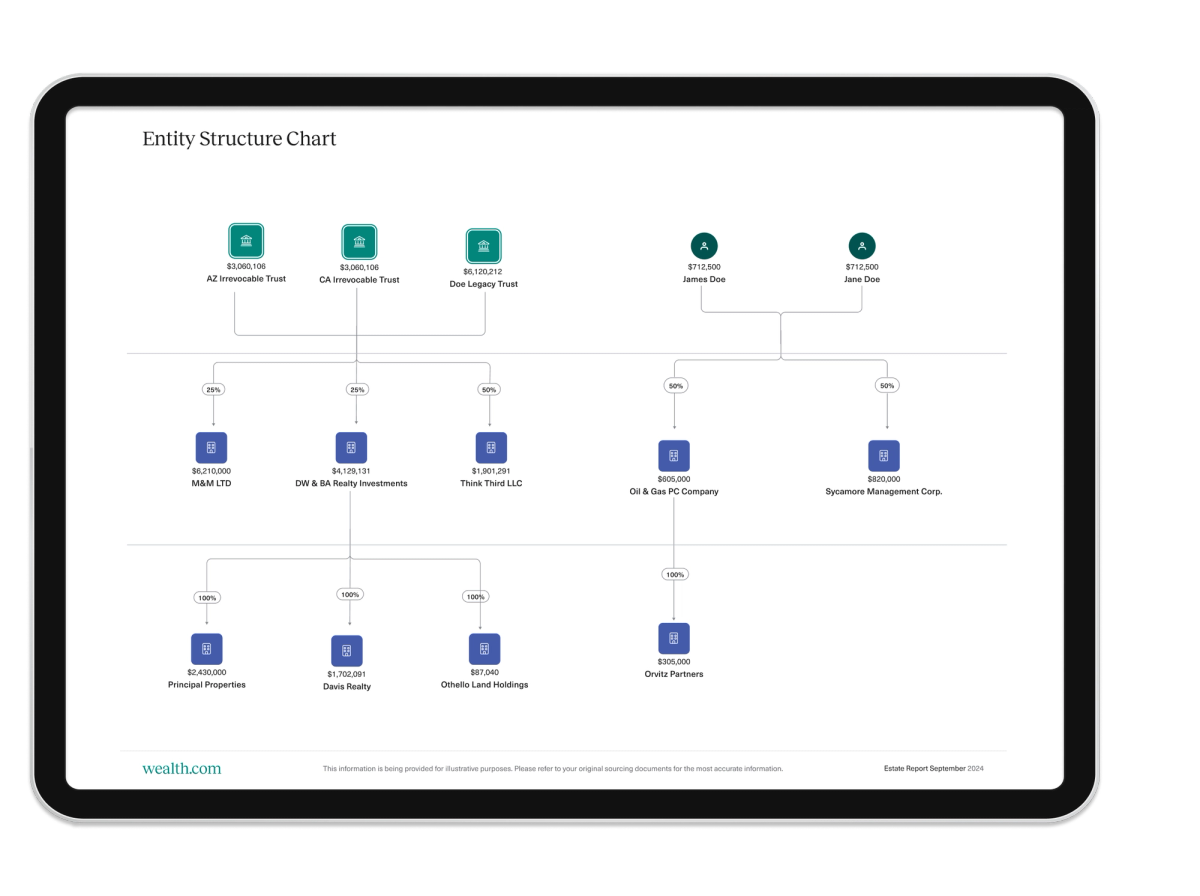

Expand legacy planning conversations leveraging the Entity Structure Flowchart

New to the Family Office Suite™: The Entity Structure Chart is automatically generated to show advisors an overview of their client’s entity holdings and the current ownership structure.

For clients who own entities, they often make up a significant part of their wealth and are an important component of legacy planning conversations. This new visualization is intended to equip advisors with the ability to identify opportunities for better succession planning and to help clients achieve tax efficiency as part of discussing their estate plan.

Easily populate client balance sheets via spreadsheet upload & mass assign ownership

While you’re able to import asset data from our ever-expanding integration list, we’ve introduced the ability to upload a spreadsheet of assets to populate your client’s balance sheet. This provides more control for advisors to create a comprehensive view of clients’ financial picture.

In addition to importing assets to set up your client’s balance sheets, you’re able to upload additional files to continue to add information as their portfolio expands over time.

Once assets are created from the spreadsheet upload, you’re also able to bulk assign ownership information to create an even more efficient process.

New Integrations: Addepar & Orion

Our ever-expanding integration list creates a frictionless experience for our partner firms. We’re excited to announce the launch of two new integrations with Addepar and Orion. These integrations allow you to sync client asset data to wealth.com to dynamically feed into clients’ estate plans, including visual reports, estate tax analysis and asset flow projections.

Improved client onboarding experience, reorder report slides, save international addresses and more

Additional updates this month address common requests we’ve received from partners:

- Financial Power of Attorney: Clients are now able to designate agents that live outside of the U.S. in their Financial Power of Attorney.

- Simplified onboarding experience: When new clients go through the onboarding workflow, they are now able to confirm their recommended primary document or can elect to choose another. The recommended primary document for them to draft includes explanations for their match alongside answers to frequently asked questions.

- Reorder slides in Report Builder: We’ve added another layer of customization to provide personalized reports for clients and collaborators! For those with the Family Office SuiteTM, you are now able to rearrange the order of slides to include before downloading the report.

- Remove clients in the “Not Invited” status: For clients that remain “Not Invited” in your Dashboard, you can now easily remove them providing better housekeeping.