The wealth.com Advisor Portal

Trusted by Industry Leaders & Top Advisors

-

Advisor Portal

-

Estate Plan Visualizer

-

Ester™ AI Extraction

-

Wealth Projections

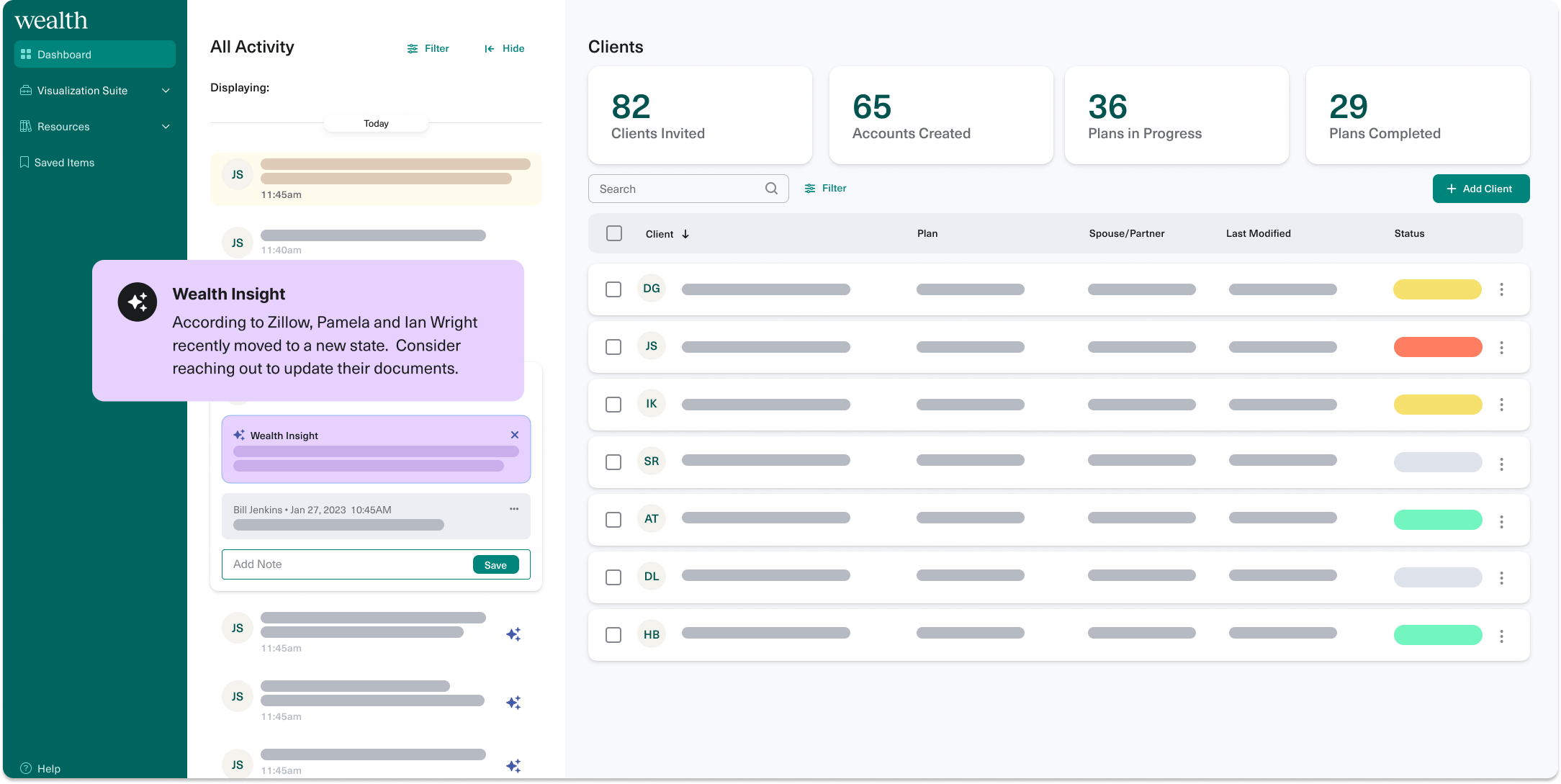

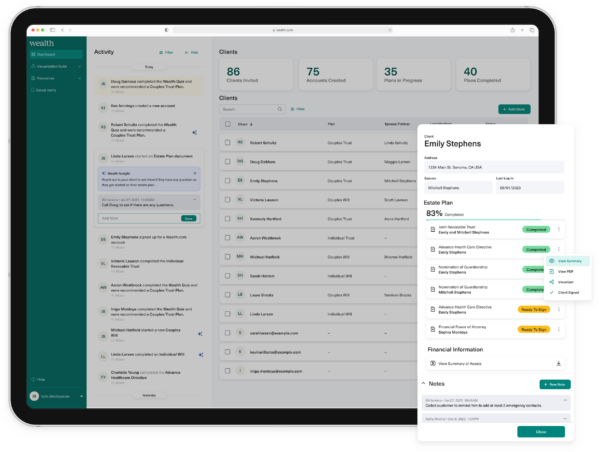

Advisor Portal

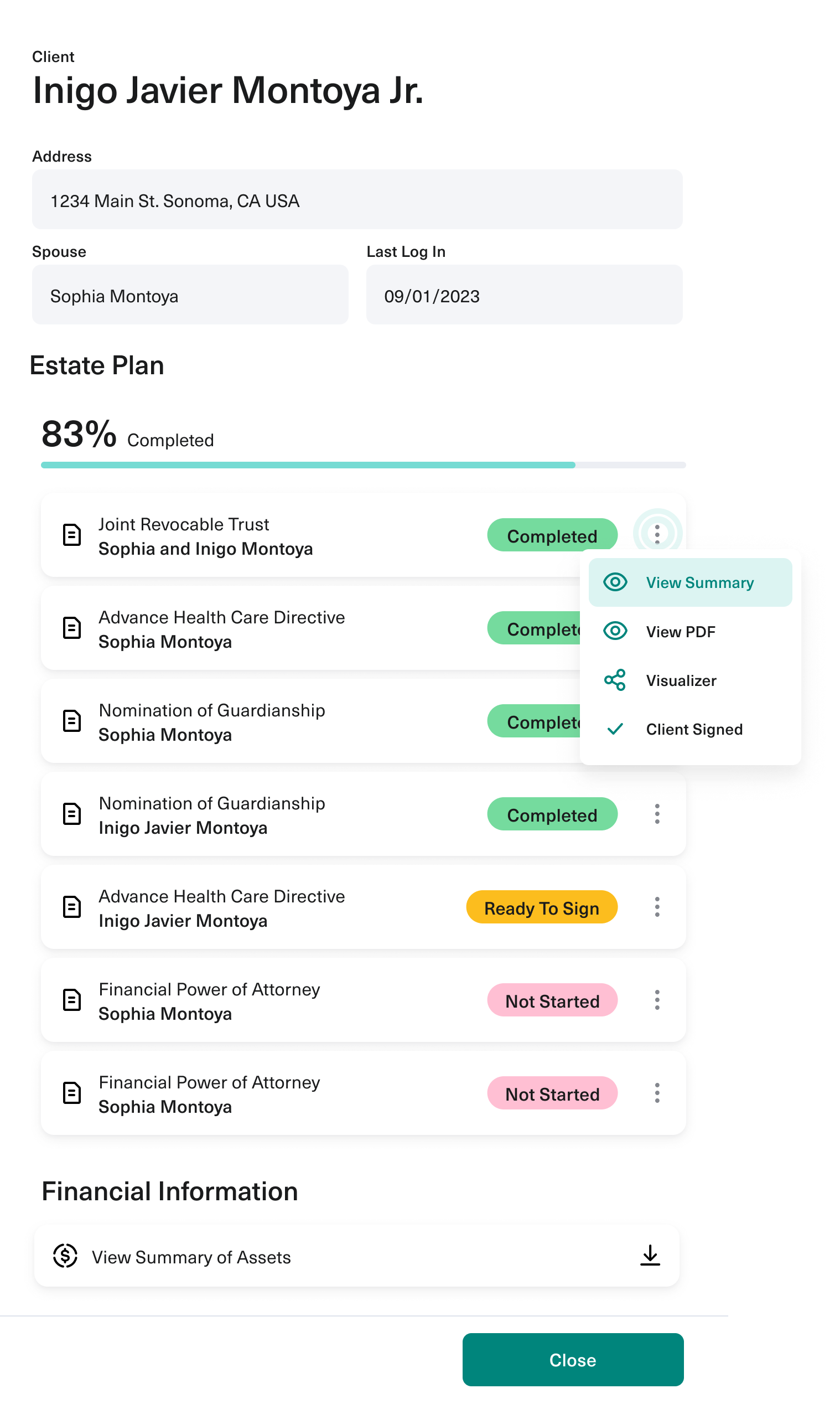

Our advisor portal gives advisors full visibility into their client’s progress, proactively surfaces insights and helps facilitate conversations around estate planning.

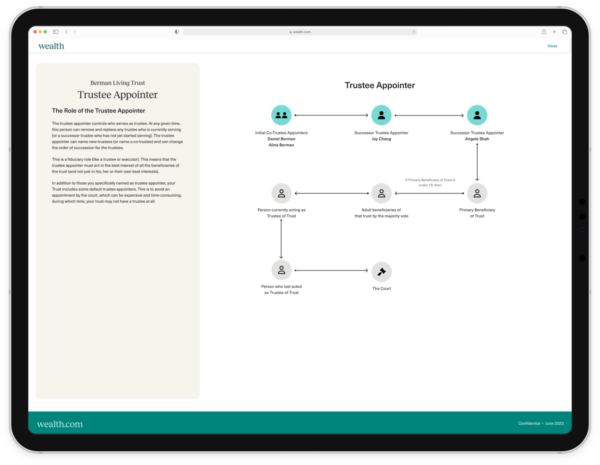

Estate Plan Visualizer

Our approach to visualizations automates much of the cumbersome manual diagram building process. It helps advisors and clients better understand how their estate plans work and the outcomes of the decisions they’re making.

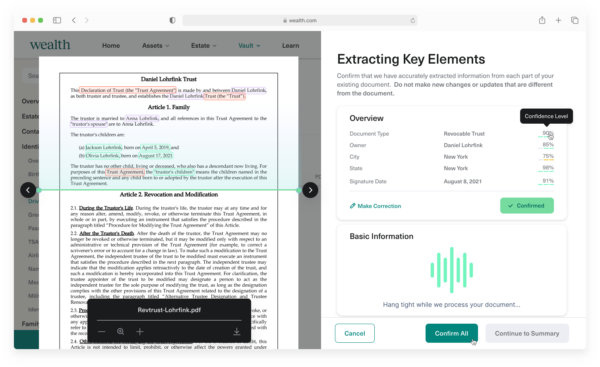

Ester™ AI Extraction

Document Extraction, a skill of Ester™ the AI Legal Assistant™, reads and analyzes existing estate planning documents, ingests them into our platform and offers personalized optimization insights for better planning.

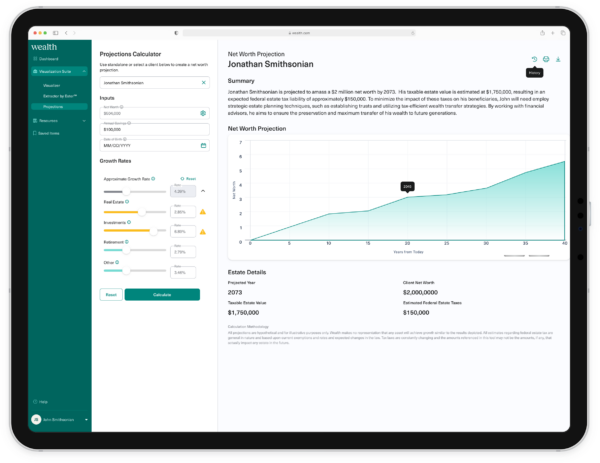

Wealth Projections

Unlike most publicly available net worth calculators that use simple exponential growth calculations, our Wealth Projections interface is built on more accurate and complex modeling that delivers unique tax projection insights.

Key Features

-

Invite your full book of business to wealth.com through our API connections with your preferred CRM.

-

Monitor progress with full visibility into the client estate planning workflows.

-

Quickly run customized reports to better understand the structure & implications of client estate plans.

-

Receive proactive insights from our intelligence engine regarding plan optimizations and client touchpoints.

-

Connect with our Partner Success team or request a consultation through our curated attorney network.

Straightforward pricing to match the rest of your tech stack.

Meet the wealth.com Advisor Council

Erik Smith is the Chief Investment Officer of 401 Financial, a Registered Investment Advisor serving clients since 2022. Prior to co-founding 401 Financial, Erik worked for Onramp Invest, a platform built to provide financial advisors and their clients access to cryptoassets. Erik is a Certified Financial Planner® and has long been an active advocate and builder within the financial planning community.

Dasarte is the founder Yarnway Wealth Management and Co-founder of ONYX Advisor Network.

He was included in the InvestmentNews 40 Under 40 in addition to being a Top 100 Financial Advisor by Investopedia from 2020-22. With 10 years of experience in serving individual clients, Dasarte's greatest professional success is seeing others achieve the life of their dreams.

Anna N’Jie-Konte, MBA, CFP® is the President and Director of Financial Planning for Re-Envision Wealth, one of the few black-owned advisory firms in the country. She currently serves as a financial advisor and investment consultant to individuals and institutions who wish to build wealth in an intentional and values-aligned fashion.

Dr. Cherry is the Founder & CEO of Concurrent Financial Planning and Director of the Financial Planning Program and the Charles Schwab Foundation Center for Financial Wellness at UW–Green Bay. Preston is an award-winning financial advisor, renowned personal finance speaker, founder, podcaster, and professor to next-generation financial planning professionals. He is also a CNBC Advisor Council and Kiplinger's Advisor Collective Member.

The wealth.com advisor council is a carefully vetted group of diverse and highly influential people in the financial advisory space who all use and love our platform. Our specialized council is truly first-of-its-kind and further demonstrates the wealth.com commitment to solving problems for financial advisors. No other estate planning entity has assembled this type of financial advisor input framework.

Samantha is the Chief Evangelist at FMG Suite and was named to the InvestmentNews 40 Under 40.

ThinkAdvisor honored her as “Luminary” for thought leadership in 2021- the inaugural year of the awards.

Thomas Kopelman is the co-founder and Lead Financial Planner of AllStreet Wealth, a financial planning firm for entrepreneurs as well as those with equity compensation. He is also wealth.com’s Head of Community. Thomas is also a blogger, podcaster, content creator and business advisor. He has been named a Top 100 Financial Advisor by Investopedia as well as one of the top 23 millennial financial planners by Business Insider.

Justin is the founder of RLS Wealth, a registered investment advisor in Fishers, Indiana, the creative collective PRST™ (pronounced Pursuit), co-founder of Advisors Growing as a Community (The AGC™), and creator of the All About Your Benjamins blog and podcast. Most importantly, he is a husband and a father to three boys.

Alex is the founder and CEO of Lake Avenue Financial. He has been helping people achieve financial freedom for over 25 years by educating them on how to build better money habits and make smarter financial decisions.

Learn more about why industry leaders love wealth.com

A demo is the best way to understand the value and ingenuity of our platform. Our partnerships team will answer any questions you have.

Schedule DemoFAQs

Once your clients have created an estate plan with Wealth, they can go into their account anytime and update their information, so their estate plans are always valid and current.

Because every state has different laws, our documents are customized to be legally compliant in the state where your clients live.

Each of our best-in-class estate planning documents are legally valid in the U.S. jurisdiction for which it was designed, including Individual and Joint Revocable Trusts (i.e., Living Trusts), Last Wills & Testaments, Advance Health Care Directives, Financial Powers of Attorney, and Nominations of Guardianship. Alongside Trust documents, members have access to additional documents including Pour-Over Wills, General Assignments, Certificates of Trust, Schedules of Property, and Wealth’s proprietary Trust Owner’s Manual. Each of our documents include signing instructions that are customized to the member’s document and state to make it easy to validate documents following state guidelines once drafting is complete.

Designed for clients and built for advisors, our platform was created with collaboration, transparency and security in mind. Advisors can administer access to clients and monitor progress as well as obtain unique client insights on an ongoing basis through the Management Dashboard.

Yes. SOC 2 Type II is a set of compliance requirements and processes targeted for third-party service providers. It was developed to help companies determine whether their vendors can securely manage data and protect the interests and privacy of their clients. Wealth is proud to be a SOC 2 Type II certified company, and we go beyond the regular Security SOC2 requirements, including Availability, Integrity, Confidentiality and Privacy requirements.

There are several ways that you can invite your clients to create their Wealth.com accounts. There is no single approach, and our Partner Success Team is here to help ensure you have the tools you need to optimize your business plan using Wealth.com. Most popular ways to invite clients: (1) Within your Dashboard, you can add email addresses to send invites individually or several at a time. Click “Invite Client” from your dashboard to get started. (2) Within the same “Invite Client” pop-up, you can copy your unique invitation link to send to your clients through your own preferred method of communication. This option is great for a customized invitation or if you are sending a mass email to your client base through a different CRM system. (3) Through your Partner Success Manager, you can bulk invite clients by providing a spreadsheet with client email addresses. Advisors appreciate the flexibility to either trigger invites, or suppress the automated invites and instead use their preferred CRM system to send more custom messages. (4) Through our partner integrations, you can connect with your CRM system and trigger invites accordingly. Please reach out to your Partner Success Team if you’re interested in learning more or getting your CRM system on our roadmap.

Your Partner Success Manager is available from the day you partner with Wealth.com to support you every step of the way. Typically, we start with a group or 1:1 onboarding call: Introduce advisors to their personal success manager. Ensure advisors can log in and walk through all features. Discuss marketing collateral and various ways we educate clients to encourage adoption. Review support channels available to advisors and their clients. Answer any specific questions you have. From there, we will continue to send you education, support, and feature releases as they become available. If you ever need assistance, you can reach out to your Partner Success Manager directly, or you can reach any member of the Wealth support team via the in-app widget or by emailing [email protected]. The experience for your clients begins once you invite them. (See “Best Practices” for more information as to the different ways you can send invitations.) Clients will receive an invitation to create an account with Wealth.com. The client will enter information through their private portal and opt-in to sharing information with advisors during the account creation process. Client data is then shared with advisors as read-only within the Advisor’s Management Dashboard. Clients are given steps on where to begin, how to get started, and resources as they begin drafting or managing their estate plans through their platform.

Your dashboard includes a summary of outstanding clients invited, clients with plans in progress, and those who have completed their estate plan. There is a table that shows your full client list, with the ability to search or filter for clients based on name, plan type, or status. You can also use the table headers to sort if you’re interested in seeing clients with the most recent activity. To access additional details about a client, click on the row with their name or use the overflow menu to read more. A panel will slide in to the right of your screen showing your client’s information, including personal details, estate plan documents and summaries, financial data pulling from their profile, activity and more.

Keeping personal information and financial data safe is our top priority. Wealth uses administrative, operational and technical security processes to protect members’ personal and sensitive information. Our SOC 2 Type II certification means that Wealth is audited against five Trust Services Criteria yearly, comprising security, availability, confidentiality, privacy and processing integrity. Multi-Factor Authentication adds an extra layer of member protection, and Wealth uses bank-level 256-Bit Encryption to ensure customer data is secure. Read more here.

The platform is designed so that your clients can fully draft and complete documents on their own time. At each step of the process, they will be provided with information to help inform them when making certain decisions, including answers to frequently asked questions, “best match” logic and educational content. If they need more hands-on support, they can speak with Wealth’s internal, United States-based Member Success Team via phone, email or chat. We also have partnerships with local counsel and can connect them to an attorney in their state (or a state of their choosing) for a consultation.