March Madness is here, and our product team has been on a tear, rolling out updates to make estate planning smoother and more intuitive. Advisors now have more ways to customize client-facing reports, organize documents, and streamline client data entry.

See all the latest updates below.

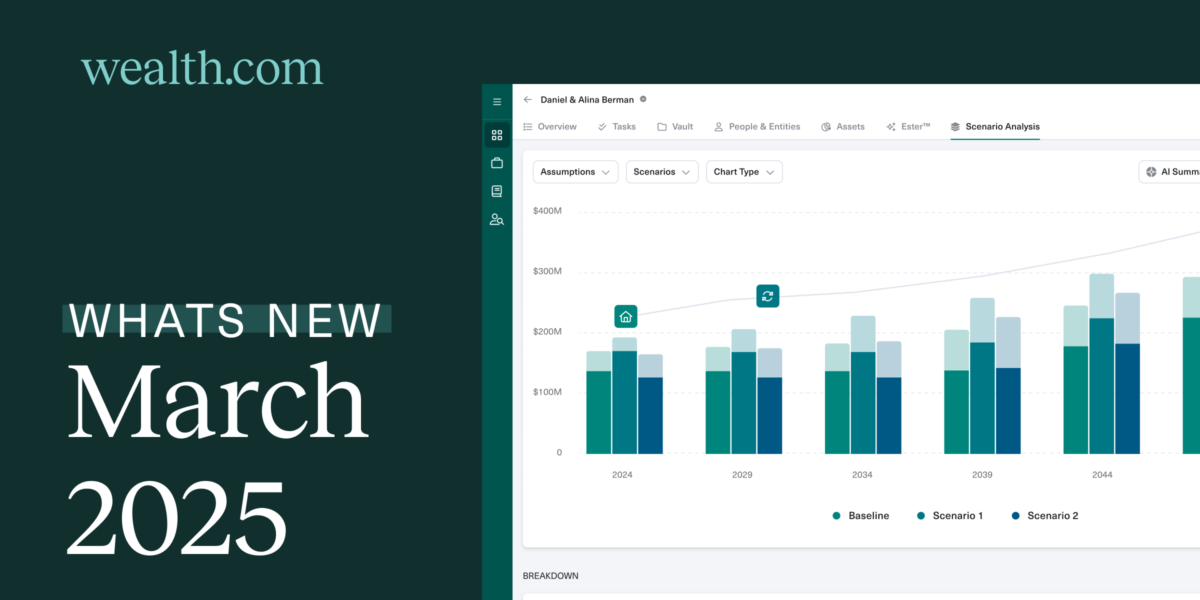

Scenario Builder: Model, Compare & Optimize Estate Strategies

Advisors need a powerful tool to help clients understand the impact of different estate planning strategies. Scenario Builder gives you an instant, side-by-side view of potential outcomes, helping you proactively discuss ways to preserve wealth and reduce estate tax liability.

With real-time calculations, you can model future events, such as asset growth and liquidity events, alongside sophisticated strategies like various irrevocable trust structures. The ability to instantly update scenarios allows you to adjust inputs on the fly and compare different scenarios in a clear, client-friendly visualization.

Report Builder: Presentation edits & privacy settings

We’ve made two major improvements to Report Builder, giving you more control over client presentations.

Editable presentation layer: Now you can add notes and comments directly into visualizations to clarify key details for your clients. These notes are included when downloading reports as PDFs or PowerPoints.

Blurred dollar amounts: A new setting lets you blur dollar amounts in reports. The toggle is off by default but can be enabled in settings to preserve privacy when sharing estate details with collaborators or beneficiaries.

Ester™ AI: Will and pour-over will differentiation

When uploading a will to Ester, you can now specify whether it’s a standard will or a pour-over will.

Pour-over wills will be automatically saved in the Revocable Trusts & Supporting Documents section of a client’s Vault, while standard wills will be stored under Wills, making it easier to keep everything organized.

Ownership Balance Sheet: Improved CSV upload template

We’ve improved the CSV upload template for assets to make data entry faster and more intuitive.

Now, when you select Upload in the Ownership Balance Sheet, you’ll have access to a refined template that includes additional details about ownership, entities, and contacts. This makes it easier to build a client’s financial picture while reducing manual data entry

Additional updates this month

- Ester auto-reprocessing: If Ester tries to analyze a document before it’s fully encrypted in the Vault, Ester will now automatically reprocess it, ensuring a smoother extraction process.

- Beneficiary update warning: We’ve added a new warning modal to clarify that changing specific gift, residuary, or ultimate beneficiaries will replace Ester-generated summaries with your new details. This helps prevent confusion between AI-generated and manually entered information

- New privacy settings: A new privacy option is now available in advisor settings, client settings, and client footer, giving you more control over how we use cookies.

- Collapsible sub-trust sections: Sub-trust sections in contact cards are now collapsible and color-coded to match flow charts in Report Builder, making it easier to organize beneficiaries.

- Hover-to-view full names: When selecting a card from People & Entities, longer names now appear in full when hovering, helping you differentiate between entities with similar naming conventions, such as trusts.

Want to learn more about these exciting updates and more? Book a personalized demo today.