One Platform For All of Your Clients

From emerging wealth to ultra high net worth, clients’ lives, assets, and tax exposure change over time. Wealth.com helps you continuously adapt estate and tax plans as those changes happen, without starting over or switching systems.

Tax Planning. Less Taxing

Tax planning shouldn’t live in spreadsheets or once-a-year conversations. Wealth.com brings tax and estate planning together in one platform, helping advisors spot opportunities sooner, model smarter decisions, and show clients how to keep more of what they’ve built.

Learn MoreFrom emerging wealth to ultra-high-net-worth, Wealth.com is the one estate and tax planning platform for all of your clients.

Serve Every Client’s Wealth Journey

Plan, Visualize, and Deliver with Confidence

Create High-Caliber Estate Plans in Minutes

Revocable Trust and Pourover Will, Last Will & Testament, Financial Power of Attorney, Advance Health Care Directive, and Guardianship Nominations—professionally crafted and optimized for your jurisdiction.

Start Creating

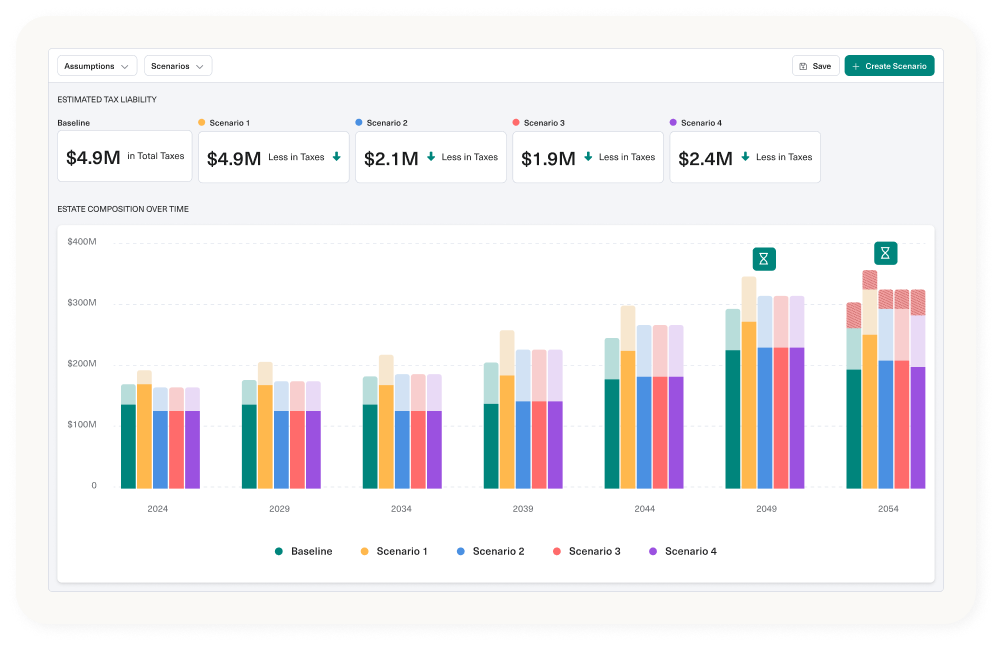

Visualize Every What-If with Confidence

Analyze tax implications, estate distributions, and planning opportunities by testing scenarios against a client’s current plan—all in one powerful tool.

See the Strategy

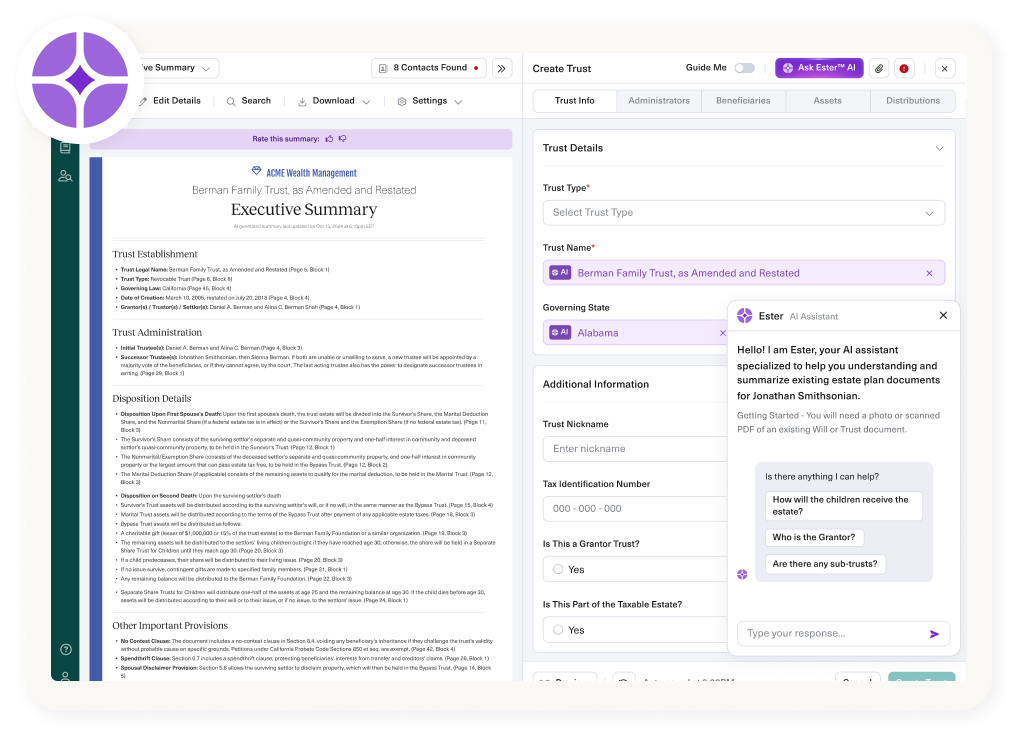

Unlock the Intelligent Future of Estate & Tax Planning

Ester® empowers you to effortlessly extract, summarize, and visualize complete estate plans and tax documents—turning complex conversations into actionable insights for clients.

Meet Ester®See How Wealth.com has Impacted Firms Like Yours

Frequently Asked Questions

Explore answers to the questions we hear most—so you can move forward with peace of mind.

Wealth.com provides a comprehensive, advisor-led estate planning platform designed to serve mass affluent to ultra-high-net-worth clients. Advisors can:

- Generate attorney-grade documents (wills, revocable trusts, powers of attorney)

- Use Ester®, our AI engine, to extract, summarize, and analyze existing documents

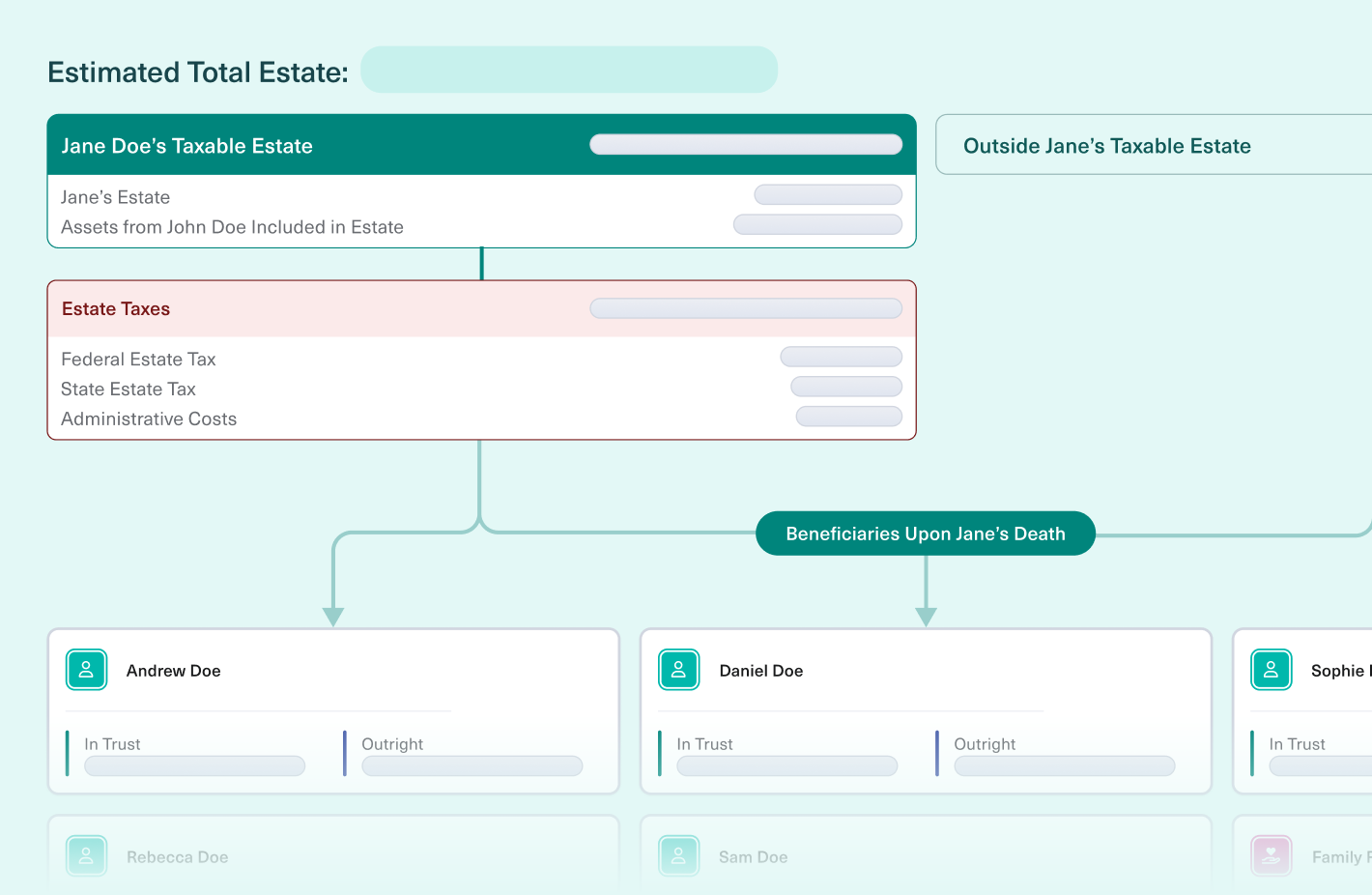

- Visualize wealth transfer scenarios and estate flows across generations

- Share and store documents securely via the Vault

- Collaborate with clients’ attorneys, CPAs, and other trusted intermediaries

This gives advisors one unified platform to meet clients where they are and guide them through life’s most important planning decisions.

Clients can only access Wealth.com through a financial advisor or wealth strategist. Once invited, they gain access to a personalized client portal to view reports, upload estate documents, and connect assets and liabilities. Wealth.com is intentionally advisor-led to strengthen relationships and ensure regulatory alignment.

Wealth.com is the industry-leading estate planning platform, recognized not only for its innovation but also for its adoption by the most respected firms in financial services. The combined AUM of wealth managers using Wealth.com exceeds $15 trillion, with many of the largest private banks, wirehouses, broker-dealers, and RIAs leveraging the platform to drive scale and efficiency for their advanced planning practices. Wealth.com is wholly independent and owned privately, but is backed by the financial and technical strength of some of the largest institutions in the world, including Google Ventures, Citi, and Charles Schwab.

Our platform was built by a cross-disciplinary team of attorneys, financial advisors, AI researchers, security experts, and engineers to address a critical need: a single estate planning solution that can serve a firm’s entire book of business, from the mass affluent to ultra-high-net-worth clients. Unlike other tools that focus narrowly on document creation, Wealth.com supports the full estate planning journey. This includes client education, document creation, execution, and ongoing monitoring of future planning and tax opportunities.

This integrated, thoughtful approach ensures the reports and documents our platform produces are accurate, client-ready, and free from the need for manual clean-up. As a result, advisors save valuable time and are empowered to deliver even greater value to their clients.

Wealth.com supports the full spectrum of estate planning needs, from foundational documents like wills, healthcare directives, and revocable trusts to the complex visualization and administration of multi-generational wealth strategies. Our platform is used by advisors serving clients across all stages of wealth, from those just beginning their planning journey to ultra-high-net-worth families with advanced estate structures.

Whether helping a young family secure a basic will and healthcare proxy or illustrating the implications of irrevocable trusts for a dynastic estate, advisors can demonstrate value clearly and confidently. Wealth.com’s Scenario Builder enables comparisons and projections that show the real impact of thoughtful planning on taxes, legacy, and family dynamics.

Wealth.com integrates directly with the tools advisors use every day, including Salesforce, eMoney, Orion, Wealthbox, Redtail, Addepar, BlackDiamond, Schwab, and more. For additional asset linking, clients can connect equity through Carta, crypto through Coinbase, and real estate through Zillow. These integrations enable advisors to deliver up-to-date planning recommendations without manual data entry.

In addition, we maintain direct API integrations with partners and are happy to explore new integrations upon request to support your firm’s specific needs.

Stay Ahead in Estate Planning

Sign up for a wealth of practical resources, industry insights, and product updates, delivered monthly.